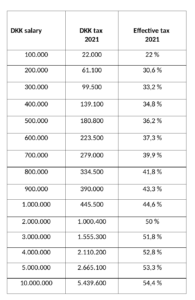

Personal income taxation in 2021

If you want an overview over the personal income taxation in Denmark in 2021, take a look below:

Just be aware with the following assumptions for the individual:

- Unmarried

- Residing in municipality with an average municipality tax rate (24,95 %)

- Only standard deductions

- Not member of Danish state church

- Marginal tax rate 2020 for personal income exceeding 519.400 DKK is 55,9 %.

- 27 % expat tax regime 2020: effective tax 32,84 %

Figures provided by inwema.dk and danishtaxreturn.dk

For assistance please contact: info@inwema.dk